We invest in

partnerships

to drive growth

MINERVA GROWTH PARTNERS

backs companies with

a strong ambition to grow.

Background

In recent years in Japan, there have been a number of cases where start-ups have not been supported by patient shareholders who properly ascribe value to those businesses which, despite near-term operating losses, are aggressively investing for future growth with upfront investments. As a result, in many of these cases post-IPO, this has resulted in volatile and stagnant share prices, thereby limiting these companies' ability to strategically invest for further growth. Furthermore, the number of late stage*institutional investors who can provide patient capital at scale are still very limited, which forces a number of start-ups to go public before they achieve sustainable profits.

*Late stage refers to a state in which the business model has been established with robust and proven unit economics with a structurally profitable financial model.

Our Mission

Minerva Growth Partners (hereinafter referred to as "MGP") provides start-ups with the option to raise sizable capital not only through IPOs, but also through private capital raising which allows them to aggressively invest capital and management resources for the strategic growth of their businesses. By doing so, we believe that Japanese start-ups will continue to invest boldly based on a long-term strategic vision, rather than simply focusing on short-term profits and losses, and that this will create greater competitiveness and vitality across these industries in Japan. By providing growth capital backed mainly by our local and global institutional investors, MGP will support the creation of the next generation category leaders from Japan whom we believe may ultimately compete globally.

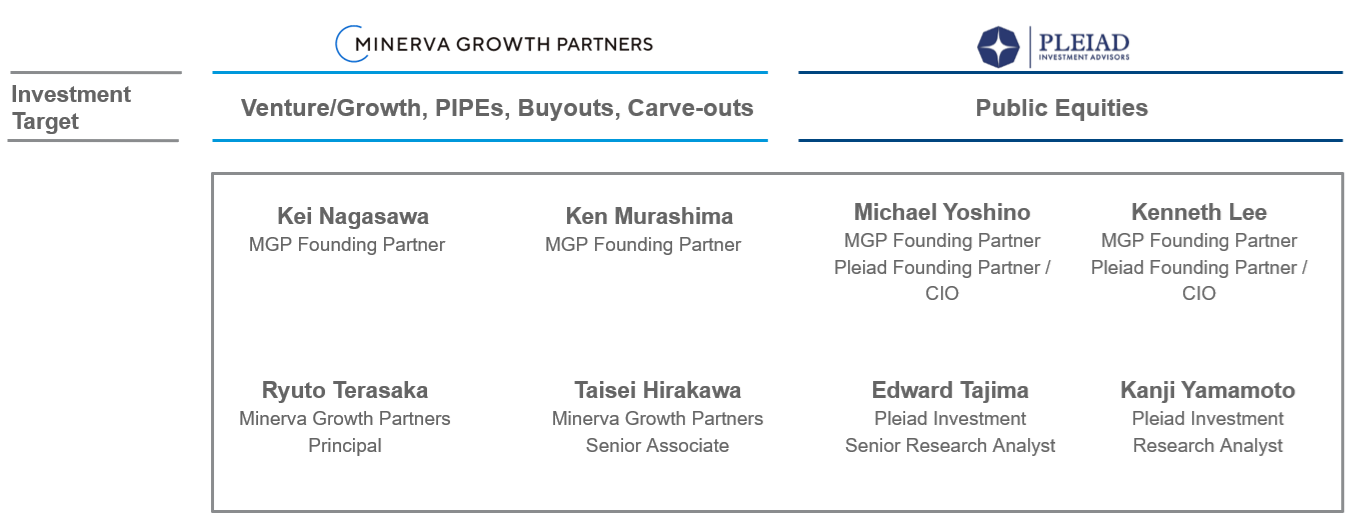

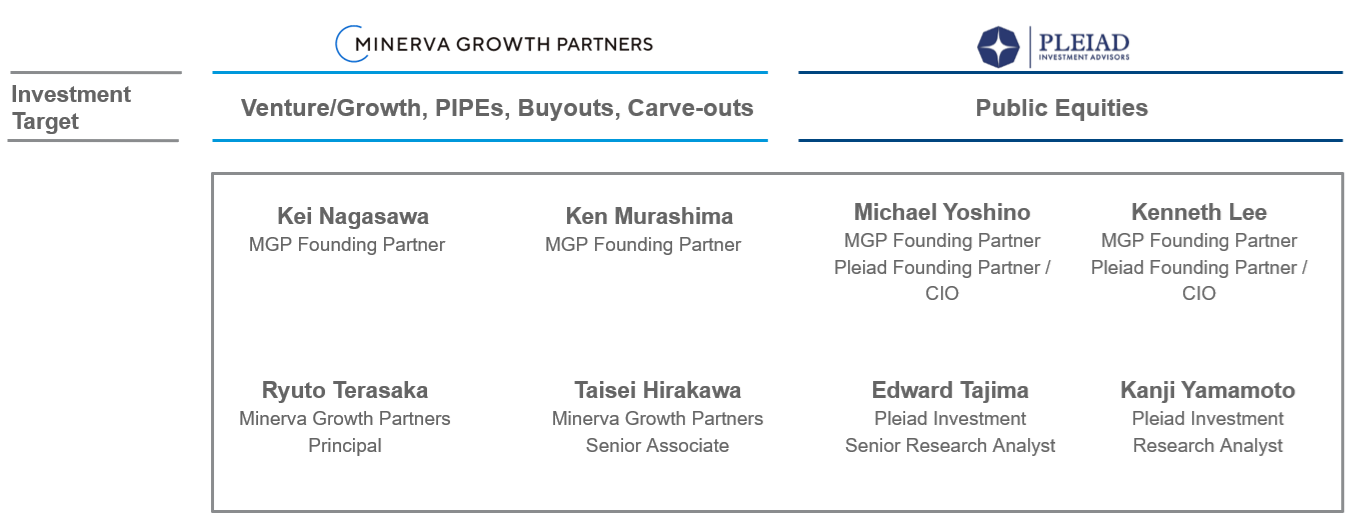

Minerva Growth Partners is established by Kei Nagasawa, former Mercari CFO, and Kensuke Murashima, former Head of Japan for Global Internet Banking/Global Software Banking Group at Morgan Stanley, together with Pleiad Investment Advisors*.

※Pleiad Investment Advisors is an independent asset management company established in Hong Kong in 2014 and is an approved asset management company by the Securities Futures and Exchange Commission (SFC) of Hong Kong. It invests in public companies in the Asia Pacific region (mainly Japan, China, and South Korea) through in-depth and extensive research, and specializes in a long-term, fundamental investment approach characterized by a relatively small number of concentrated holdings. Pleiad has a track record of investing in a variety of newly-listed growth stocks among Japanese start-ups. http://pleiadadvisors.com

Kei Nagasawa

Founding Partner, Minerva Growth Partners

After working in the investment/M&A advisory division mainly in energy, retail, and food sector at Mitsubishi Corporation, he joined Goldman Sachs Investment Banking Department in 2007 where he was responsible for financial advisory services including M&A and IPOs, mainly in the technology sector in Tokyo and San Francisco. Nagasawa became CFO at Mercari, Japan’s first private unicorn to raise capital twice, and took the company public in June 2018. He resigned as CFO in September 2020. Graduated from Keio University, and an MBA from University of Chicago.

Kensuke Murashima

Founding Partner, Minerva Growth Partners

After engaging in new business development and corporate venture capital focused in the technology sector in Japan and overseas at Mitsubishi Corporation, Ken joined Morgan Stanley in 2007. Since then, he had been solely in the technology investment banking in its Tokyo and Silicon Valley (Menlo Park) offices with focuses on financing of public and private companies, IPO, and on M&A and strategic investment advisory. He led a series of landmark IPO transactions including LINE, Mercari, Raksul and freee as Head of Japan for Morgan Stanley's Global Internet Banking and Global Software Banking Group. Graduated from Keio University, and an MBA from Duke University.

Michael Yoshino

Founding Partner, Minerva Growth Partners

Founding Partner and

Chief Investment Officer (CIO), Pleiad

After his career at TPG Capital (private equity, Tokyo), Tiger Asia Management (Asian equities, New York), and Soros Fund Management (Asian equities, New York / Hong Kong), he founded Pleiad in 2014 and became Chief Investment Officer. He has a wealth of experience in research and investment in Japanese companies, both private and public, as a fund manager. Graduated from Yale University, and an MBA from the Kellogg School of Management. He played as a professional ice hockey player for Oji Paper in Japan for two years after graduating from Yale.

Kenneth Lee

Founding Partner, Minerva Growth Partners

Founding Partner and

Chief Investment Officer (CIO), Pleiad

After his career at TPG Capital (private equity investment in Hong Kong), Tiger Asia Management (Asian equity investment in New York), Sequoia Capital (public and private equity investment), and Soros Fund Management (Asian equity investment in New York and Hong Kong), he founded Pleiad in 2014 and became Chief Investment Officer. He has a wealth of experience in research and investment in Asian companies, both private and public, as a fund manager. Graduated from Amherst College, and an MBA from Harvard University.

Edward Tajima

Senior Research Analyst, Pleiad

After working at TPG Capital (private equity, Tokyo), Shumway Capital (global equities, New York), and Fidelity International (Japanese equity, Tokyo), he joined the firm in 2024. He graduated from the Marshall School of Business at the University of Southern California. Certified Public Accountant in the United States.

Ryuto Terasaka

Principal, Minerva Growth Partners

Prior to joining Minerva in March 2022, Ryuto was a Vice President at J.P. Morgan Investment Banking Department, where he focused on financing of public and private companies, IPO, M&A and strategic investment advisory for Internet, Media, and Technology companies both in Tokyo and New York office. Graduated from Waseda University.

Kanji Yamamoto

Research Analyst, Pleiad

Prior to joining Minerva in February 2022, Kanji was an analyst at Japan Growth Investment Alliance (J-GIA), where he was part of the private equity team working on buyouts/growth investments. Kanji started his career at Credit Suisse in the equity research department, focusing on both the autos/auto components sectors. Graduated from Keio University.

Taisei Hirakawa

Senior Associate, Minerva Growth Partners

Prior to joining Minerva in October 2024, Taisei was an associate at McKinsey & Company focusing on turnaround and growth strategy of startups, and business due diligence for private equity firms. He also worked on organization transformation, M&A strategy, PMI and DX projects across TMT and manufacturing industries in Tokyo and Los Angeles. Graduated from the University of Tokyo.

Masaki Taniguchi

Founding Partner and

Chief Operating Officer (COO), Pleiad

After his career at GSAM (head of product development for Asia Pacific), SPARX Group (Group Chief Operating Officer), and Goldman Sachs (Managing Director) in Hong Kong , he founded Pleiad in 2014 and became Chief Operating Officer. He has over 20 years of experience in the asset management industry both in Japan and in Hong Kong, and is fluent in English, Japanese and Mandarin Chinese. Graduated from University of Kyoto, and holds a Masters degree in Law from the University of Tokyo.

Minerva-Pleiad Group

Advisory Board

Minerva Growth Partners welcomes the following members (listed in alphabetical order), who have experienced IPOs with growth capital funding as well as managing global businesses. As Advisory Board Members, they will provide support for our portfolio companies based on their wealth of management experience.

Fumiaki Koizumi

President, Mercari, Inc. and Chief Executive Officer, Kashima Antlers FC

Daisuke Sasaki

Chief Executive Officer, freee K.K.

Yo Nagami

Representative Director, President & Group CEO, Raksul Inc.

Ray Hatoyama

Chief Executive Officer, Hatoyama Soken Corporation

Growth-Stage Investing

Minerva Growth Partners ("MGP") plans to invest from 1 to 3 billion yen per company, primarily targeting growth stage private companies that have established product-market fit (PMF), revenue models, and an attractive unit economics to grow towards 10 billion yen scale in sales. In addition, we will also make private equity investments in growth-stage public companies and their business units and subsidiaries. Our focus areas include consumer internet and B2B software and services including healthcare tech and fintech.

Buyouts / PIPEs / Carve-outs

As a private equity fund focused on growth companies in the technology sector, MGP is able to offer a variety of strategic solutions, not only limited to investments in unlisted companies, but also buyouts, private investments in public equities (PIPEs), and carve-outs of specific business units or subsidiaries. In particular, we support companies who have concerns regarding their valuation in the capital markets, liquidity and stock price which make it difficult to raise capital, preventing them from pursuing proactive measures. MGP addresses these issues through providing strategic solutions through our private equity investments.

Private-Public Crossover

MGP is capable of a long-term holding period from pre to post-IPO, allowing an investment across the company’s entire lifecycle. Pleiad Investment Advisors can also invest at an IPO and post-IPO and build large positions in the public markets for long and super-long holding periods.

Partnership

Our team with a highly unique and diverse background, has ample experience in public and private investments, investment banking, and in business operations. We will create long-term partnerships with our portfolio companies as well as provide ongoing support for management teams post-IPO.

Press Release

2025.3.27

Minerva Growth Partners invests in CADDi’S Series C Extension Round

(Japanese Press Release)

2024.4.26

Minerva Growth Partners invests in enechain’s Series B Round

(enechain’s Japanese Press Release)

2023.3.1

Minerva Growth Partners invests in CAMPFIRE’s Series F Round

(CAMPFIRE’s Japanese Press Release)

2022.2.18

Minerva Growth Partners invests in enechain’s Series A Round

(enechain’s Japanese Press Release)

ARK Hills Executive Tower S702, 1-14-5 Akasaka,

Minato-ku, Tokyo, 107-0052